Who's Improving Bioprocessing In 2014?

By Eric Langer, president and managing partner, BioPlan Associates, Inc.

Last month we discussed the broad trends in innovation in bioprocessing that will shape the next five years. These include better single-use devices, assays, connectors and system integrations, and alternatives to chromatography. This month we drill down into areas where product innovators are actually investing in these improvements and technologies. Below is a sampling of key bioprocessing innovations. A thorough treatment would require an encyclopedia; this is an appetizer for what’s to come.

Last month we discussed the broad trends in innovation in bioprocessing that will shape the next five years. These include better single-use devices, assays, connectors and system integrations, and alternatives to chromatography. This month we drill down into areas where product innovators are actually investing in these improvements and technologies. Below is a sampling of key bioprocessing innovations. A thorough treatment would require an encyclopedia; this is an appetizer for what’s to come.

2014 will be another year of advancement for biopharmaceutical bioprocessing and manufacturing. This will include continued incremental advances that allow manufacturers to do more with less: less capital investment, lower operational cost, less time (speed to market), and better labor usage. Some specific examples include the ability to manufacture using smallerscale equipment and facilities aided by ever-increasing process yields; better cell lines, expression systems, and optimized culture media; increased adoption of single-use bioprocessing equipment; and better downstream/purification technologies and equipment.

Of course, biopharmaceutical development and manufacture is not an area conducive to rapid revolutionary changes (e.g. having a significant impact in a single year). For example, it has taken more than a decade for single-use bioreactors to dominate the small- and mid-scale manufacturing market. The industry retains an inherent conservatism in adopting new technologies in this highly regulated environment, which is partially due to the expectation that new inventions used in manufacturing can potentially delay a drug product’s approval.

New and Innovative Bioprocessing:

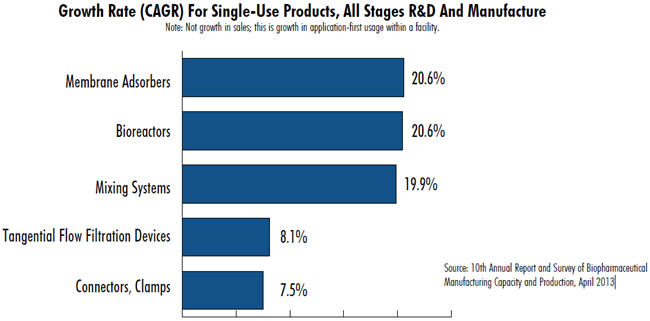

Membrane Adsorbers: Downstream purification has been thoroughly dominated by chromatography columns, generally stainless steel (recycled, non-single-use). In contrast, membrane adsorbers involve multiple layers of adsorptive filters, are much smaller, processing is faster, and are single-use, requiring no column packing, cleaning, sterilization, etc. Although these are mostly for cleanup of recombinant protein/antibody purification streams to remove targeted impurities, their applications are advancing as binding capacities increase and costs are reduced. Upcoming membrane adsorbers include those used in classic bind-elute mode, allowing them to replace more cumbersome separation non-single-use media-packed columns. For example, Natrix Separation has launched NatriFlo HD-Q Membranes that deliver binding capacity which exceeds resin-based columns with fast flow-rates typical of membrane adsorbers. According to our 10th Annual Report and Survey of Biopharmaceutical Manufacturing, membrane adsorbers are the fastest-growing bioprocessing market segment. New membrane adsorbers continue to be launched, including products from the current market leaders Sartorius Stedim and Pall Corp. and from Natrix Separations, Asahi Kasei, BIA, and others.

Modular Bioprocessing: Beyond just single-use bioprocessing systems, whole unit facilities and bioprocessing unit operations are becoming single-use. This essentially involves portable, modular cleanrooms, often fully fitted with singleuse bioprocessing equipment. For example, G-Con offers trailer-like modular cleanrooms with bioprocessing equipment preinstalled, and GE Healthcare Life Science offers KUBio preassembled biopharmaceutical factories. In 2013, JHL Biotech (China) contracted with GE for delivery of a KUBio GMP biopharmaceutical factory in China, with this to be fully ready in as short as 14 to 18 months. And G-Con, a major innovator in modular systems, formed a collaboration with Foster Wheeler, a major engineering and construction firm, to offer G-Con modules globally. Modular bioprocessing facilities are particularly attractive for use in developing and other GMP-challenged countries. For example, in 2013, the Brazilian government licensed beta-glucocerebrosidase carrot cell culture manufacturing technology from its developer, Protalix BioTherapeutics, and contracted with GE Healthcare and iBio, Inc., a company with plant expression technology, to build a large manufacturing facility in Brazil to supply the country’s need for this product.

Biosimilars Manufacturing: The FDA is slowly issuing needed biosimilars development and approval guidelines, but no applications have yet been filed in the U.S. However, innovations to streamline the production of biosimilars is now a major worldwide focus, considering biopharmaceuticals have >$100 billion in current sales, and nearly 100 products are coming off patent in the U.S., EU, and other major markets in the next three to six years. More than 550 biosimilars, most in the earliest stages, have been reported in the development pipeline, along with more than 400 biobetters (see www. biosimilarspipeline.com). Biosimilars are resulting in a rapid expansion of bioprocessing, with literally hundreds of new potential entrants worldwide viewing biosimilars as a route to U.S. and EU markets. Thus, any innovation that streamlines, simplifies, or reduces bioprocessing costs will likely be viewed positively by this market segment.

Protein A And Replacements: For a long time, Protein A has dominated initial recombinant antibody capture and purification. And with original Protein A-related patents held by Repligen and GE expiring, new entrants are rapidly entering the market. This includes higher-performing (e.g. high antibody- binding) and more generic broadly applicable Protein A separation resins, all essentially targeted to capture the markets held by the market leader, the Mab Select SuRe product line from GE. With Protein A quite expensive and essentially involving the use of one GMP-produced recombinant protein to purify another, the industry continues to seek more cost-effective alternatives. Other alternatives entering the market include high-capacity ion exchanger (CEX) resins; recombinant camel- (camelid) and llamaderived antibody-based resins, such as from BAC BV (now Life Technologies, Inc.); and custom-designed binding ligands, such as from Prometic Biosciences. Crystallization, polyethylene glycol (PEG) precipitation, expanded-bed absorption (EBA), and simulated moving-bed (SMB) chromatography will likely be among the other technologies entering the market in coming years that will be used for initial antibody capture and purification steps.

Process Monitoring: Sensors and other devices to monitor processes are another area where new products and technologies continue to enter the market. Single-use sensors are in great demand, and available sensors are often not robust enough for use in bioreactors. Adoption of process analytical technology (PAT) continues slowly, with it not yet reduced to precanned software.

Prepacked Chromatography Columns: Prepacked chromatography columns, generally used several times, are not yet single-use, but this is another area where suppliers are rapidly launching new products. BioPlan survey data shows that 27% of decision makers are now at least considering adopting prepacked columns. The number of vendors and variety of products available continues to increase. Protein A prepacked columns are expected to be launched in 2014.

Summary

There continues to be widespread dissatisfaction with the pace of innovations in bioprocessing. For example, 44 percent of respondents to our annual study desire improvements to basic single-use components, 27 percent want analytical assays improvements, and 25 percent want to see cell culture products and technologies improve. This kind of demand will fuel the industry’s R&D expenditures for the foreseeable future.

Survey Methodology: The BioPlan annual survey of biopharmaceutical manufacturers yields a composite view and trend analysis from over 300 responsible individuals at biopharmaceutical manufacturers and CMOs in 29 countries. The methodology included over 150 direct suppliers of materials, services, and equipment to this industry. This year’s study covers such issues as new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, budgets in disposables, trends in downstream purification, quality management and control, hiring issues, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the world’s major markets in the U.S. and Europe.

If you want to learn more about the report, please go to bioplanassociates.com.